As filed with the Securities and Exchange Commission on August 14, 2019

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CARDAX, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 45-4484428 | ||

(State of incorporation) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2800 Woodlawn Drive, Suite 129

Honolulu, Hawaii 96822

(808) 457-1400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David G. Watumull

President and Chief Executive Officer

Cardax, Inc.

2800 Woodlawn Drive, Suite 129

Honolulu, Hawaii 96822

(808) 457-1400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Richard M. Morris, Esq. Allegaert Berger & Vogel LLP 111 Broadway, 20th Floor New York, New York 10006 (212) 571-0550

|

Barry I. Grossman, Esq. Sarah E. Williams, Esq. Ellenoff, Grossman & Schole LLP 1345 Avenue of the Americas, New York, NY 10105 (212) 370-1300 |

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [X] | Smaller reporting company [X] | |

| Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act [ ]

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Proposed maximum aggregate offering price(1) | Amount of registration fee(2) | ||||||

| Units consisting of shares of Common Stock, par value $0.001 per share, and warrants to purchase shares of Common Stock, par value $0.001 per share | $ | 17,250,000 | (3) | $ | 2,090.70 | |||

| Common stock included as part of the Units | - | - | ||||||

| Warrants to purchase common stock included as part of the Units(4) | - | - | ||||||

| Common stock underlying Warrants | $ | 17,250,000 | $ | 2,090.70 | ||||

| Representative’s Warrants(5) | - | - | ||||||

| Common stock underlying Representative’s Warrants(5) | $ | 1,707,750 | $ | 206.98 | ||||

| Total | $ | 36,207,750 | $ | 4,388.38 | ||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate public offering price. |

| (3) | Equal to $15,000,000 of securities to be offered by us plus the underwriter’s option to purchase up to an additional 15% of the total number of shares offered by us, or up to an additional $2,250,000 of securities, at the public offering price, less underwriting discounts, to cover over-allotments, if any, within 45 days after the date of this prospectus. |

| (4) | No separate registration fee is required pursuant to Rule 457(g) under the Securities Act. |

| (5) | We have agreed to issue upon the closing of this offering, warrants to Maxim Group LLC entitling it to purchase up to 9.0% of the aggregate securities sold in this offering. The exercise price of the warrants is equal to 110% of the public offering price of the common stock offered hereby. The warrants are exercisable commencing six (6) months after the date of effectiveness of this Registration Statement and will terminate five (5) years after the date of effectiveness of this Registration Statement |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not offer these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus August 14, 2019

P R O S P E C T U S

_______ Units

Each Unit Consisting of _______ Shares of Common Stock and

_______ Warrants to Purchase _______ Shares of Common Stock

This prospectus relates to our offering of ______ units of Cardax, Inc., a Delaware Corporation (the “Units”). Each unit consists of ______ shares of our common stock and ______ warrants (a “Purchase Warrant”) to purchase ______ shares of our common stock at an exercise price of $______ per share and will expire five years from the date of issuance. The Units will not be certificated and the shares of common stock and the Purchase Warrants are immediately separable and will be issued separately in this offering.

Our common stock is quoted for trading on the OTCQB Marketplace (the “OTCQB”) under the symbol “CDXI.” As of August 13, 2019, the last reported sales price for our common stock as quoted on the OTCQB was $0.10 per share. There is no established trading market for the Purchase Warrants. Quotes of stock trading prices on an over-the-counter marketplace may not be indicative of the market price on a national securities exchange. We have applied to have our common stock and Purchase Warrants listed on the Nasdaq Capital Market under the symbols “CDXI” and “CDXIW,” respectively. We believe that upon the completion of the offering contemplated by this prospectus, we will meet the standards for listing on the Nasdaq Capital Market. We cannot guarantee that we will be successful in listing our common stock or our Purchase Warrants on the Nasdaq Capital Market, or, if successful, that an active trading market for our common stock or Purchase Warrants will develop or be sustained.

The share and per share information in this prospectus does not reflect the proposed reverse stock split of the authorized and outstanding common stock of 1-for-____ to occur on or prior to the effective date of the offering. The number of shares of common stock will be determined primarily on the basis of the pricing of our Units in this offering. This prospectus will be amended by an amendment to this registration statement to reflect such number and the effect of such reverse stock split, except that we will not reflect the reverse stock split in our Financial Statements and the Notes thereto.

__________________________

An investment in our securities involves a high degree of risk. Before buying any securities you should carefully read the discussion of the material risks of investing in our securities in “Risk Factors” beginning on page 12 of this prospectus.

__________________________

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Unit | Total (Not Including Over-Allotment) | Total (Including Over-Allotment) | ||||||||||

| Public offering price | ||||||||||||

| Underwriting discounts(1) | ||||||||||||

| Proceeds, before expenses, to us | ||||||||||||

| (1) | We refer you to “Underwriting” beginning on page 61 for additional information regarding total underwriting compensation. |

The underwriters may also purchase up to an additional _________ shares of common stock and/or Purchase Warrants from us at the public offering price, less the underwriting discounts payable by us, to cover over-allotments, if any, within forty-five (45) days from the date of this prospectus.

The underwriters expect to deliver the shares of common stock and Purchase Warrants to investors on or about , 2019.

__________________________

Sole Book-Running Manager

Maxim Group LLC

The date of this prospectus is_________ , 2019.

TABLE OF CONTENTS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission. You should rely only on the information contained in this prospectus or to which we have referred you. Neither we nor the underwriters have authorized anyone to provide any information or to make any representations other than those contained in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Through and including (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside the U.S.: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the U.S. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

| i |

FORWARD-LOOKING STATEMENTS

There are statements in this prospectus that are not historical facts. These “forward-looking statements” can be identified by use of terminology such as “anticipate,” “believe,” “estimate,” “expect,” “hope,” “intend,” “may,” “plan,” “positioned,” “project,” “propose,” “should,” “strategy,” “will,” or any similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control, including those summarized in this prospectus, such as our ability to develop and commercialize or otherwise monetize our pharmaceutical product candidates as planned, the impact of changes in healthcare regulation, and our ability to raise additional capital to fund our pharmaceutical development activities. For a discussion of these risks, you should read this entire prospectus carefully, especially the risks discussed under the section entitled “Risk Factors.” Although we believe that our assumptions underlying such forward-looking statements are reasonable, we do not guarantee our future performance, and our actual results may differ materially from those contemplated by these forward-looking statements. Our assumptions used for the purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances, including the development, acceptance and sales of our products and our ability to raise additional funding sufficient to implement our strategy. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. In light of these numerous risks and uncertainties, we cannot provide any assurance that the results and events contemplated by our forward-looking statements contained in this prospectus will in fact transpire. These forward-looking statements are not guarantees of future performance. You are cautioned to not place undue reliance on these forward-looking statements, which speak only as of their dates. We do not undertake any obligation to update or revise any forward-looking statements, except as required by law.

CAUTIONARY NOTE REGARDING INDUSTRY DATA

Unless otherwise indicated, information contained in this prospectus concerning our company, our business, the services we provide and intend to provide, our industry and our general expectations concerning our industry are based on management estimates. Such estimates are derived from publicly available information released by third party sources, as well as data from our internal research, and reflect assumptions made by us based on such data and our knowledge of the industry, which we believe to be reasonable.

| ii |

This summary highlights selected information contained elsewhere in this prospectus and does not contain all the information that you should consider before making your investment decision. Before investing in our common stock and warrants to purchase common stock, you should carefully read this entire prospectus, including the information set forth under the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus and our consolidated financial statements and the accompanying notes included in this prospectus. Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Cardax,” the “Company,” “we,” “us,” and “our” refer to Cardax, Inc. together with its wholly-owned subsidiary, Cardax Pharma, Inc., a Delaware corporation (“Pharma”), and Pharma’s predecessor, Cardax Pharmaceuticals, Inc., a Delaware corporation (“Holdings”), which merged with and into Cardax, Inc. on December 30, 2015 (the “Holdings Merger”). Unless otherwise noted, references in this prospectus to our “product” or “products” includes our pharmaceutical candidates, dietary supplements, and any of our other current or future products, product candidates, and technologies, to the extent applicable.

Overview

We are a development stage biopharmaceutical company focused primarily on the development of pharmaceuticals to safely address one of the major underlying causes of many chronic diseases – inflammation – including cardiovascular disease, metabolic disease, liver disease, arthritis, and aging. We also have a commercial business unit that markets dietary supplements for inflammatory health. We believe we are well positioned for growth through the utilization of astaxanthin and zeaxanthin for chronic pharmaceutical applications by safely reducing chronic inflammation at the cellular and mitochondrial level – without inhibiting normal function. Similar mechanisms also support the use of our dietary supplement for inflammatory health.

We believe that our pharmaceutical product candidates and our dietary supplements have competitive advantages, primarily relating to a unique combination of the following benefits:

| ● | An excellent safety profile that supports chronic use | |

| ● | Broad anti-inflammatory activity and pleiotropic effects with potential application to several chronic diseases as pharmaceuticals and various areas of health as dietary supplements | |

| ● | Oral dosing convenience | |

| ● | Scalable manufacturing | |

| ● | Economical pricing |

Market Overview

There is broad acceptance in the scientific, medical, and financial communities that chronic inflammation is a significant factor in many chronic diseases, particularly cardiovascular disease. The double-blind, randomized, placebo-controlled CANTOS clinical trial (10,061 patients; Novartis, 2017) and REDUCE-IT clinical trial (8,179 patients; Amarin Corporation, 2018), both published in the New England Journal of Medicine, helped to catalyze and support this consensus. Commonly used anti-inflammatory drugs such as aspirin, ibuprofen, naproxen, COX-2 inhibitors, corticosteroids, and various biologics may reduce inflammation, but they have risks of significant side effects that limit their utility in chronic disease.

We believe that a safe anti-inflammatory is the solution. Our lead pharmaceutical candidate CDX-101, a proprietary prodrug of the naturally occurring marine molecule astaxanthin, may provide the needed combination of an excellent safety profile, anti-inflammatory activity, and economic pricing to become widely used for the prevention and treatment of chronic diseases driven by inflammation.

We are pursuing an initial indication of severe hypertriglyceridemia (triglycerides ≥ 500 mg/dL) for CDX-101. Severe hypertriglyceridemia is associated with chronic inflammation and patients with the disorder have increased cardiovascular disease risk and incidence of pancreatitis. We believe the clinical pathway to U.S. Food and Drug Administration (“FDA”) drug approval for severe hypertriglyceridemia, which relies on biomarker endpoints (i.e., measuring triglycerides in blood tests over a period of several months), will be more efficient than other potential indications that require clinical outcomes studies (e.g., evaluating heart attacks, strokes, and deaths over a period of several years), and is thus better suited as our initial indication for CDX-101.

An estimated 3.4 million Americans have severe hypertriglyceridemia according to peer-reviewed research published in the American Journal of Cardiology in 2011. Statins, fibrates, and prescription fish oils are all used to manage hypertriglyceridemia. 21% (42 million) of U.S. adults have mixed dyslipidemia (high levels of low-density lipoprotein “LDL” cholesterol with low levels of high-density lipoprotein “HDL” cholesterol and/or high levels of triglycerides), with nearly 6% (11.6 million people) having all three lipid abnormalities. Lovaza, Vascepa, and other prescription fish oils approved for severe hypertriglyceridemia are also used off-label in mixed dyslipidemia patients to reduce moderately elevated triglycerides and aggregate sales of these products for on and off-label use are estimated to be approaching $2 billion annually.

We believe CDX-101 will have several competitive advantages compared to prescription fish oils: (i) ease of administration: oral dosing of large fish oil capsules is problematic, whereas we expect CDX-101 tablets should be far smaller; (ii) scalability: prescription fish oil manufacturing is limited by the declining global fish supply, whereas we believe the synthetic production of CDX-101 is scalable; and (iii) safety: prescription fish oils have certain safety risks, whereas we believe that astaxanthin, the active moiety of CDX-101, has an excellent safety profile.

The REDUCE-IT clinical trial demonstrated that administration of Vascepa resulted in a significant reduction of major adverse cardiovascular events (“MACE”) in patients with mixed dyslipidemia on standard of care, specifically statins, and we believe is the primary basis of Amarin’s request to the FDA to expand Vascepa’s label. The reduction of triglycerides in the REDUCE-IT clinical trial was modest however, and the study’s authors concluded that Vascepa’s ability to reduce other markers of cardiovascular disease, including inflammation and oxidized LDL (as demonstrated in the MARINE and ANCHOR clinical trials), provided the pleiotropic effects that led to reduction of MACE in REDUCE-IT. In human proof-of-concept “pilot” studies conducted by third parties and animal models conducted by third parties and us, astaxanthin, the active moiety of CDX-101, has demonstrated similar pleiotropic effects, which are derived from its broad anti-inflammatory activity, but without the limitations of Vascepa or other prescription fish oils. As a result, we believe this market also presents a major opportunity as a potential second indication for CDX-101.

| 1 |

Beyond cardiovascular disease, we believe CDX-101 could be developed to address other chronic diseases driven by inflammation, including metabolic disease, liver disease, arthritis, and aging, each with potential annual sales exceeding a billion dollars.

We are also developing CDX-301, our zeaxanthin pharmaceutical candidate, for macular degeneration. Our target initial indication for CDX-301 is Stargardt disease, a juvenile form of macular degeneration and potential orphan drug indication. Zeaxanthin has a mechanism of action and excellent safety profile similar to astaxanthin, however, it accumulates in the human eye through uptake by a unique retinal receptor, providing protection against blue light, oxidative damage, and related inflammation that occurs in macular degeneration. Pre-clinical and clinical studies with zeaxanthin have demonstrated proof-of-concept for the treatment of macular disorders. Based on multiple academic and NIH sources, we believe there are no more than 42,000 persons in the United States with Stargardt disease, and therefore we believe a treatment for Stargardt disease may qualify for orphan drug designation. (By statute, the FDA may grant orphan drug designation to a drug intended to treat a rare disease or condition that affects less than 200,000 persons in the United States.) If CDX-301 receives FDA orphan drug designation for Stargardt disease and obtains FDA drug approval, we expect CDX-301 may benefit from certain advantages as an orphan drug, including orphan drug exclusivity, which means the FDA may not approve any other application, including a full NDA, to market the same drug for the same indication for a period of seven years, except in limited circumstances. We also believe that age related macular degeneration, a larger market estimated to afflict more than three million people in the U.S. alone, presents a major opportunity as a potential second indication for CDX-301. We do not expect to use the proceeds of this offering to pursue the development of CDX-301.

Astaxanthin

Astaxanthin Safety

Astaxanthin is a naturally occurring marine carotenoid found in salmon, microalgae, krill, lobster, and crab. Carotenoids are natural pigments that impart coloration and support animal health and vitality, especially in harsh marine environments. Astaxanthin is responsible for the characteristic red or pink color of salmon and shellfish. Salmon without astaxanthin are smaller, more susceptible to infection, have reproductive problems, and are not strong enough to swim upstream.

Astaxanthin is Generally Recognized as Safe (“GRAS”) as a food substance according to FDA regulations and has undergone extensive toxicity testing by third parties and us with no clinically meaningful issues even at the extremely high doses summarized in the table below:

| Type of Study | Maximum Dosing | |

| Acute Toxicity | >8,000 mg/kg (mouse, rat), 2,000 mg/kg (non-human primates) | |

| Sub-Chronic Toxicity | 1,240 mg/kg (rat), 160 mg/kg (dog) | |

| 1 Year Chronic Toxicity/Carcinogenicity | 1,000 mg/kg (rat), 1,400 mg/kg (mouse), 200 mg/kg (dog) | |

| 2 Year Carcinogenicity | 1,000 mg/kg (rat) | |

| Genotoxicity/Mutagenicity | 2,000 mg/kg (mouse) | |

| Teratogenicity | 1,000 mg/kg (rat), 400 mg/kg (rabbit) |

Commonly used anti-inflammatory drugs such as aspirin, ibuprofen, naproxen, COX-2 inhibitors, corticosteroids, and various biologics have risks of side effects including gastrointestinal bleeding, heart attacks, strokes, and severe infections. Prescription fish oil drugs, while safer than common anti-inflammatory drugs, also have risks of certain side effects. Lovaza and other DHA, EPA combination fish oil drugs, have risks of side effects including back pain, eructation, dysgeusia, and increases in LDL cholesterol. Vascepa has risks of side effects including arthralgia, atrial fibrillation, and increased bleeding. Fenofibrates have risks of side effects including stomach pain, nausea, and back pain.

In contrast, astaxanthin has no known side effects of clinical significance. We believe astaxanthin’s excellent safety profile will be a key competitive advantage compared to other drugs targeting inflammation and lipids.

Astaxanthin Mechanism of Action

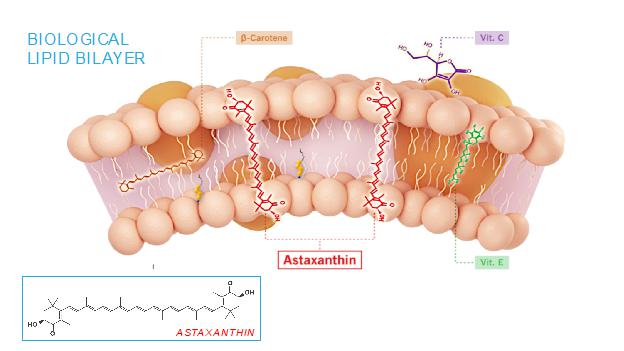

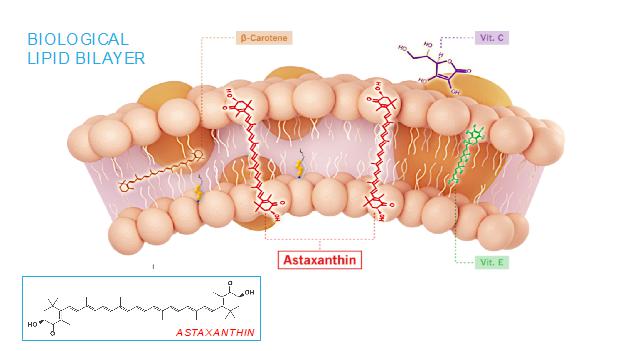

The mechanism of action of astaxanthin, the active moiety in CDX-101, is quite different than most drugs, and we believe is responsible for its excellent safety profile. Most drugs target single receptors or enzymes in complex pathways, which can lead to side effects with chronic use. Astaxanthin is distributed systemically, including to the liver and heart, where it localizes in cellular and mitochondrial membranes and reduces the oxidative stress that causes chronic inflammation, without affecting the normal function of inflammatory/metabolic signaling pathways. And unlike other antioxidants such as beta-carotene, Vitamin C, and Vitamin E, astaxanthin spans and stabilizes cellular and mitochondrial membranes (biological lipid bilayers) to function as an aqueous and lipid phase antioxidant without membrane disruption, as proven by X-ray diffraction studies:

| 2 |

As a result, astaxanthin demonstrates positive and quantifiable pleiotropic effects on many inflammatory cytokines and drug targets.

In human proof-of-concept “pilot” studies with astaxanthin conducted by third parties:

| ● | TNF-α was significantly reduced (-30%, p=0.0022) | |

| ● | C-Reactive Protein (“CRP”) was significantly reduced (-20%, p<0.05; two studies) | |

| ● | Oxidative stress was significantly reduced (MDA, IsoP, SOD, TAC increased) |

In animal studies with astaxanthin conducted by third parties:

| ● | Inflammatory markers were reduced in various model systems |

| ○ | TNF-α, IL-1β, IL-6, CRP, NF-kB, PGE-2, iNOS, MCP-1, ERK, JNK, COX-2 | ||

| ○ | TNF-α reduced equivalent to an equal dose of prednisolone |

| ● | Pathway inhibition (NF-kB) and activation (PI3K/AKT, adiponectin) | |

| ● | Oxidative stress reduced in mitochondria |

Astaxanthin Research Results

There are more than 1,800 published peer reviewed papers related to astaxanthin, including more than 50 peer reviewed papers published by Cardax and its collaborators (referred to herein as “us”) and more than 50 “pilot” human clinical trials with astaxanthin supplements, more than 20 of which were randomized, double-blind, placebo-controlled human proof-of-concept studies. As discussed in greater detail under “Business – Astaxanthin Research Results” on page 34 of this prospectus, highlights of astaxanthin’s pleiotropic effects, which were demonstrated in studies utilizing astaxanthin from natural and synthetic sources, include:

| ● | Astaxanthin and Cardiovascular Disease: In human proof-of-concept “pilot” studies conducted by third parties, astaxanthin significantly reduced inflammation, triglycerides, LDL-cholesterol, and blood pressure. In animal studies conducted by third parties and us, astaxanthin demonstrated efficacy in models of cardiovascular disease. | |

| ● | Astaxanthin and Metabolic Disease: In human proof-of-concept “pilot” studies conducted by third parties, astaxanthin raised adiponectin levels, lowered TNF-α levels, and impacted oxidative stress. In animal studies conducted by third parties, astaxanthin demonstrated efficacy in models of metabolic disease. | |

| ● | Astaxanthin and Liver Disease: In human proof-of-concept “pilot” studies conducted by third parties, astaxanthin decreased fat accumulation in biopsy-diagnosed nonalcoholic steatohepatitis (“NASH”) patients, reduced TNF-α, improved lipid profiles, and impacted oxidative stress. In animal studies conducted by third parties and us, astaxanthin decreased elevated liver enzymes, lipids, insulin resistance, steatosis, and fibrosis. | |

| ● | Astaxanthin and Arthritis: In human proof-of-concept “pilot” non-arthritis studies conducted by third parties, astaxanthin significantly reduced markers of inflammation of relevance to arthritis, including TNF-α and CRP. In animal studies conducted by third parties, astaxanthin reduced inflammation and joint degeneration. | |

| ● | Astaxanthin and Aging: In human studies conducted by third parties, activation of the FOXO3 gene has been linked to the reduction of inflammation and aging. In animal studies conducted by third parties and us, astaxanthin activated the FOXO3 gene and extended lifespan. |

| 3 |

Our Products and Business Strategy

Our product platform consists of our development stage pharmaceutical candidates and our commercially available dietary supplement:

| ● | CDX-101, our lead pharmaceutical candidate, is in pre-clinical development for cardiovascular inflammation and dyslipidemia, with a target initial indication of severe hypertriglyceridemia. | |

| ● | CDX-301 is in pre-clinical development for macular degeneration, with a target initial indication of Stargardt disease. | |

| ● | ZanthoSyn® is a physician recommended astaxanthin dietary supplement for inflammatory health. |

Lead Pharmaceutical Candidate: CDX-101

Our lead pharmaceutical candidate, CDX-101, is a proprietary astaxanthin prodrug that cleaves following oral administration and delivers astaxanthin to the bloodstream. CDX-101 is being developed initially for cardiovascular inflammation and mixed dyslipidemia, with a target initial indication of severe hypertriglyceridemia.

We believe that the results from two major cardiovascular clinical trials—the 10,061 patient CANTOS study by Novartis in 2017 and the 8,179 patient REDUCE-IT study by Amarin in 2018—clearly demonstrated the clinical significance of reducing chronic inflammation, validating the cardiovascular inflammation hypothesis we have supported for more than a decade. We believe that astaxanthin’s unique mechanism of action—reduction of oxidative stress driven inflammation at the cellular and mitochondrial level without inhibiting normal function—results in an impact on key inflammatory drug targets and pathways, and importantly, an excellent safety profile that supports chronic administration. In addition to the safety advantages described herein, we believe that production of CDX-101, unlike Vascepa and other prescription fish oil drugs, will be highly scalable to address these large mass markets for chronic diseases driven by inflammation.

Clinical and non-clinical studies with astaxanthin have provided proof-of-concept for the treatment of cardiovascular risk factors including inflammation and triglycerides as described herein. We believe that an initial indication of severe hypertriglyceridemia provides an efficient clinical pathway to drug approval for CDX-101 and will be similar to the pathway as reported by Amarin for the development of Vascepa, its prescription fish oil. CDX-101 is currently in pre-clinical development, including the planning of Investigational New Drug (“IND”) enabling studies. We plan to use proceeds from this offering to complete IND enabling studies and a Phase I clinical trial, as well as to engage third party contract development and manufacturing organizations (CDMOs) to manufacture drug substance and drug product for such studies, with the goal of filing an IND in Q4 2020 and completing a Phase I clinical trial by mid-2021.

We have retained Paresh N. Soni, M.D., Ph.D., the former Senior Vice President and Head of Development at Amarin, to guide our clinical and regulatory strategy, interact with the FDA, and advise us on a full range of development issues. While at Amarin, Dr. Soni led the design of Amarin’s clinical trials, development strategy, and interaction with the FDA, including for Vascepa, which was approved for treatment of severe hypertriglyceridemia in 2012. Dr. Soni played a key role in the design and conduct of the MARINE, ANCHOR, and REDUCE-IT clinical trials with Vascepa. Dr. Soni is also a member of our Scientific Advisory Board.

In addition to Dr. Soni, our Scientific Advisory Board includes Deepak L. Bhatt, M.D., M.P.H. and R. Preston Mason, Ph.D.

Deepak L. Bhatt, M.D., M.P.H., is the Chairman of our Scientific Advisory Board. Dr. Bhatt is also the Chair of the REDUCE-IT clinical trial with Vascepa, Executive Director of Interventional Cardiovascular Programs at Harvard Medical School affiliated Brigham and Women’s Hospital, and Professor at Harvard Medical School. He is also the Editor of the peer-reviewed Journal of Invasive Cardiology and Editor-in-Chief of the Harvard Heart Letter for patients.

R. Preston Mason, Ph.D. is on the faculty of the Department of Medicine, Division of Cardiology at Harvard Medical School affiliated Brigham and Women’s Hospital. He has published more than 250 peer reviewed papers, including papers published in collaboration with Cardax, and is a recognized expert on the mechanism of action of astaxanthin and fish oils, particularly Vascepa.

CDX-101 vs. ZanthoSyn®

CDX-101 is a synthetic astaxanthin prodrug (new chemical entity) for pharmaceutical applications and ZanthoSyn® is a formulation of synthetic nature-identical astaxanthin for dietary supplement applications. While both deliver astaxanthin to the bloodstream, we believe the unique molecular structure of CDX-101 and its pharmaceutical pathway will provide substantial differentiation. In particular, we believe that:

| ● | CDX-101 will be approved by the FDA as a drug for one or more disease indications, whereas ZanthoSyn® is marketed as a dietary supplement for health applications; | |

| ● | CDX-101 will be prescribed by doctors and covered by health insurance, whereas ZanthoSyn® is sold through retail and e-commerce channels; | |

| ● | CDX-101 will be administered at a higher dose and in different oral dosage form; and | |

| ● | CDX-101 will have superior intellectual property protection. |

| 4 |

Pharmaceutical Candidate: CDX-301

Our zeaxanthin pharmaceutical candidate, CDX-301, has a mechanism of action and excellent safety profile similar to astaxanthin, however, it is being developed for macular degeneration because zeaxanthin accumulates in the human eye through uptake by a unique retinal receptor, providing protection against blue light, oxidative damage, and related inflammation that occurs in macular degeneration. Pre-clinical and clinical studies with zeaxanthin have demonstrated proof-of-concept for the treatment of macular disorders. We believe that an initial indication of Stargardt disease, a juvenile form of macular degeneration, provides an efficient clinical pathway to drug approval for CDX-301. On November 30, 2018, we submitted a request for orphan drug designation to the FDA for zeaxanthin as a treatment of Stargardt disease, and we are currently in communications with the FDA regarding this matter. Additional financing beyond that contemplated in this offering will be needed to fund IND enabling studies and clinical development of CDX-301.

Dietary Supplement: ZanthoSyn®

ZanthoSyn® is our commercially available physician recommended astaxanthin dietary supplement. Astaxanthin is a naturally occurring molecule with safe anti-inflammatory activity that supports cardiovascular health, metabolic health, liver health, joint health, and longevity. The form of astaxanthin utilized in ZanthoSyn® has demonstrated an excellent safety profile in peer-reviewed published studies and is GRAS according to FDA regulations.

We sell ZanthoSyn® primarily through wholesale and e-commerce channels. We launched our e-commerce channel in 2016 and began selling to General Nutrition Corporation (“GNC”) stores in 2017. ZanthoSyn® is currently available at GNC corporate stores nationwide in the United States.

ZanthoSyn® is the top selling product at GNC stores in Hawaii and the top selling product in the anti-oxidant category at GNC stores nationwide.

We market ZanthoSyn® primarily through a multi-pronged approach:

| ● | Physician outreach and education, where ZanthoSyn® is positioned as the first safe, physician friendly, anti-inflammatory dietary supplement for health and longevity, with retail locations and e-commerce serving as convenient and credible distribution channels for physicians recommending ZanthoSyn® | |

| ● | Retail store outreach, education, and in-store sales support, building on the ability to utilize ZanthoSyn® as a foundation of health and wellness regimens | |

| ● | E-commerce platforms |

We believe ZanthoSyn® is physician friendly for several reasons:

| ● | ZanthoSyn® delivers the safety, purity, manufacturing rigor, bioavailability, and scientific support that provides physicians comfort in the quality and utility of the product, which is often not present in other dietary supplements. | |

| ● | ZanthoSyn® is well-accepted at medical conferences where crowds of physicians and other healthcare professionals stand in line to receive ZanthoSyn® samples and product information after attending educational seminars. |

Our sales and marketing program was initially launched in Hawaii, where we believe that robust physician outreach and education coupled with GNC retail store outreach, education, and in-store sales support increased consumer awareness and catalyzed strong sales growth. We also launched this program in major markets on the West Coast and East Coast in the U.S. beginning in 2017. To support these efforts, we have hired additional sales and marketing personnel. We are currently evaluating our strategy related to further expansion.

We currently sell ZanthoSyn® to GNC under a purchasing agreement that includes an exclusivity provision for the “brick and mortar” retail channel in the United States. On July 11, 2019, we notified GNC that the exclusivity provision of our purchasing agreement with GNC will not automatically renew on October 16, 2019, however, the other provisions of our purchasing agreement with GNC shall remain in effect. Following expiration of exclusivity, we will have the right to expand ZanthoSyn® distribution to mass market retailers, other specialty nutrition stores, pharmacies, and other retailers. We may consider continuing exclusivity with GNC in the “brick and mortar” retail channel in the United States if mutually acceptable terms are reached, which may include arrangements related to sales support, marketing, and inventory commitments by GNC.

In September 2018, we initiated a human clinical trial in Honolulu, Hawaii entitled, Cardiovascular Health Astaxanthin Supplement Evaluation (“CHASE”), targeting cardiovascular inflammatory health. The randomized, double-blind, placebo-controlled clinical trial is evaluating the effect of low-dose and high-dose ZanthoSyn® on cardiovascular health as measured by CRP levels over 12 weeks in up to 120 subjects with documented cardiovascular risk factors. The study will also include an optional open label extension through 48 weeks. Interim results from an initial cohort of approximately 33% of the target enrollment are expected to be available in September 2019.

The FDA does not require human clinical trials for dietary supplements, but we believe that positive results from the CHASE trial may help promote scientific and consumer awareness of astaxanthin’s health and longevity applications and serve as further proof-of-concept for our CDX-101 clinical program.

| 5 |

We are also exploring the effect of ZanthoSyn® on recovery, endurance, and performance in a clinical study (the Recovery, Endurance, and Performance with ZanthoSyn® or “REPZ” study) with 40 subjects in Honolulu, Hawaii, the results of which, if successful, may be used to support ZanthoSyn® marketing efforts for sports and fitness applications.

Benefits of Synthetic Astaxanthin vs. Natural Astaxanthin

Dietary supplements containing astaxanthin typically derive astaxanthin from microalgae, krill, or other natural sources, whereas ZanthoSyn® astaxanthin is made through total synthesis. While multiple studies demonstrate that astaxanthin from either natural or synthetic sources is efficacious and both are Generally Recognized as Safe according to FDA regulations, we believe synthetic astaxanthin offers significant advantages compared to astaxanthin from microalgae, krill, or other natural sources:

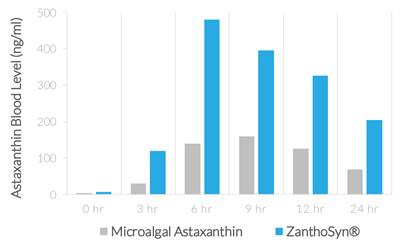

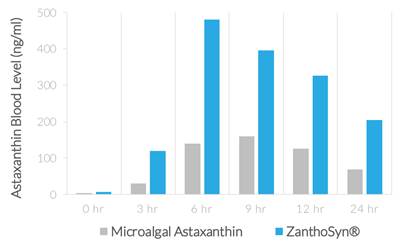

| ● | Synthetic astaxanthin can be formulated for superior bioavailability. In a human crossover study comparing ZanthoSyn® to a leading microalgal astaxanthin dietary supplement, the astaxanthin blood levels following administration of ZanthoSyn® were nearly three times higher than the microalgal astaxanthin product at the same dose: |

| ● | AUC (area under curve, astaxanthin blood levels) = 2.85-fold greater (p=0.013) | |

| ● | Cmax (maximum concentration, astaxanthin blood levels) = 3.0-fold greater (p=0.013) | |

| ● | Coefficient of variation (variation between subjects of astaxanthin blood levels) |

| o | ZanthoSyn® = 27% | |

| o | Microalgal astaxanthin = 62% |

| ● | Tmax (time of maximum concentration) = 6 hours | |

| ● | No adverse events |

The superior bioavailability described herein means that three times more astaxanthin from ZanthoSyn® is absorbed into the body from each dose, which provides a superior value proposition compared to other astaxanthin dietary supplements.

| ● | Synthetic astaxanthin has been extensively tested in a wide range of toxicity studies, including acute, sub-acute, sub-chronic, and chronic toxicity studies, carcinogenicity studies, genotoxicity/mutagenicity studies, and developmental and reproductive toxicity studies; whereas to our knowledge microalgal or other sources of astaxanthin have not undergone the same amount of safety testing in such toxicity studies. | |

| ● | Synthetic astaxanthin is manufactured with superior purity and precision, whereas astaxanthin extracted from microalgae and krill oil is obtained in a complex mixture, which may include many unknown marine byproducts. | |

| ● | Synthetic manufacture of astaxanthin is scalable, whereas we believe the ability to readily scale the production and extraction of astaxanthin from microalgae or other sources will be limited as demand for astaxanthin grows. | |

| ● | Synthetic manufacture of astaxanthin emits fewer greenhouse gases and consumes less energy, raw material, and land than traditional microalgal astaxanthin production. |

| 6 |

Intellectual Property

We have obtained and are continuing to seek patent protection for compositions of matter, pharmaceutical compositions, and pharmaceutical uses, in certain disease areas, of our various carotenoid analogs and derivatives. Such carotenoids include astaxanthin, zeaxanthin, lutein, and/or lycophyll, and esters and other analogs and derivatives of these compounds. More specifically, we seek to protect: (i) the composition of matter of novel carotenoid analogs and derivatives, (ii) pharmaceutical compositions comprising synthetic or natural preparations of novel or natural occurring carotenoid analogs and derivatives, and (iii) the pharmaceutical use of synthetic preparations of novel or naturally occurring carotenoid analogs and derivatives in specific disease areas, including, but not limited to, the treatment of inflammation and related tissue damage, liver disease, and reperfusion injury, as well as the pharmaceutical use of synthetic or natural preparations of novel or natural occurring carotenoid analogs and derivatives for the reduction of platelet aggregation. We intend to enforce and defend our intellectual property rights consistent with our strategic business objectives.

We have 28 issued patents and two pending patents related to the composition of matter, pharmaceutical compositions, and pharmaceutical uses of our drugs candidates as well as many other related molecules that will expire between 2023 and 2028, subject to patent term extensions. We have filed and intend to file additional patents to extend patent coverage in the U.S. and abroad to at least 2039.

The Company’s patents are summarized in the table below.

| United States | Foreign | Expiration | ||||||||||

| Issued Patents | 14 | 14 | 2023-2028 | |||||||||

| Pending Patents | 0 | 2 | 2023-2028 | |||||||||

| Pending Patents | 1 | 0 | 2039 | |||||||||

Reverse Stock Split

Prior to the date that this prospectus is effective, our Board of Directors (the “Board”) will have approved and our stockholders will have approved a reverse stock split of our common stock within the range that is considered appropriate and necessary for our common stock to have a targeted trading price per share that meets the listing requirements of The Nasdaq Capital Market, at a minimum, and such other price determined appropriate by our Board, and our Board will have authorized the Pricing Committee of our Board of Directors (the “Pricing Committee”), in its sole discretion, to determine the final ratio of shares for such reverse stock split on the effective date, and date of filing of the certificate of amendment in connection with the reverse stock split.

On ______, the Pricing Committee established a ratio for the reverse stock split of 1-for-______ and the reverse stock split was effective at 12:01 a.m. on ______ (the “Reverse Stock Split”). Trading of our common stock on a post-Reverse Stock Split basis began at market open on ______. No fractional shares were issued in the Reverse Stock Split and any remaining share fractions were rounded up to the next whole share.

In connection with the Reverse Stock Split, the Company’s authorized shares were reduced by the 1-for-______ ratio. Also, all shares of our common stock subject to outstanding equity awards and the exercise price of any such award (if applicable) and the number of shares remaining available for issuance under the Cardax, Inc. 2014 Equity Compensation Plan as amended, and all shares underlying outstanding preferred stock and other derivative securities of the Company, including exercise prices and conversion rates (if applicable) were proportionately adjusted for the Reverse Stock Split.

Increase in Authorized Shares

Prior to the date that this prospectus is effective, our Board will have approved and our stockholders will have approved an amendment to the Company’s Certificate of Incorporation to increase the authorized shares of our common stock to a range of ______ to ______ (the “Authorized Share Increase”) and authorized the Pricing Committee, in its sole discretion, to determine the final amount. This amendment to the certificate of incorporation will be filed on or prior to the effective date of this prospectus.

Corporate Information

We are a development stage biopharmaceutical company engaged in the development and commercialization of pharmaceuticals and dietary supplements. We are a smaller reporting company as defined by applicable federal securities regulations. Our common stock is traded on the OTCQB under the trading symbol “CDXI”. On the effective date of this prospectus, we expect that trading on NASDAQ will be under the same symbol. We also intend to seek a listing for the Purchase Warrants on NASDAQ under the symbol “CDXIW.”

Our executive offices are located at 2800 Woodlawn Drive, Suite 129, Honolulu, Hawaii 96822. Our telephone number is (808) 457-1400. Our website is located at http://www.cardaxpharma.com. The information on our website is not part of this prospectus.

Summary of Risk Factors

Investing in our common stock and warrants to purchase common stock involves substantial risk. You should carefully consider all of the information in this prospectus before investing in our common stock and warrants to purchase common stock, including the risks related to this offering and our common stock, our business and industry, our intellectual property, our financial results, and our need for financing, each as described under the section titled “Risk Factors” and elsewhere in this prospectus.

| 7 |

Our business is subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. You should read these risks before you invest in our common stock. In particular, our risks include, but are not limited to, the following:

| ● | We have a history of operating losses, have received a going concern opinion from our auditors, and may not have sufficient funds to complete the development and commercialization of our pharmaceutical candidates. | |

| ● | Our management will have broad discretion as to the use of proceeds from this offering, and we may not use the proceeds effectively. | |

| ● | An active, liquid, and orderly market for our common stock or Purchase Warrants may not develop. | |

| ● | The Purchase Warrants may not have any value. | |

| ● | A number of different factors could prevent us from developing or commercializing our products on a timely basis, or at all. | |

| ● | We operate in highly competitive industries, and our failure to compete effectively could adversely affect our market share, financial condition and growth prospects. If competitors are better able to develop and market products that are more effective, or gain greater acceptance in the marketplace than our products, our commercial opportunities may be reduced or eliminated. | |

| ● | The pharmaceutical and dietary supplement industries are subject to extensive and complex healthcare regulation. Any determination that we have violated federal or state laws applicable to us that regulate healthcare would have a material adverse effect on our business, prospects, and financial condition. | |

| ● | If we fail to comply with FDA regulations our business could suffer. | |

| ● | Orphan drug designation for our products may not confer marketing exclusivity or other expected benefits. | |

| ● | We rely on third parties to supply and manufacture our products. If these third parties do not perform as expected or if our agreements with them are terminated, our business, prospects, financial condition, and results of operations would be materially adversely affected. | |

| ● | Our ability to market our products may be impaired by the intellectual property rights of third parties. | |

| ● | We may be involved in lawsuits or proceedings to protect or enforce our intellectual property rights or to defend against infringement claims, which could be expensive and time consuming. | |

| ● | Our ability to grow and compete in the future will be adversely affected if adequate capital is not available to us or not available on terms favorable to us. | |

| ● | Provisions in our corporate charter documents and under Delaware law could make an acquisition of us more difficult and may prevent attempts by our stockholders to replace or remove our current management. |

| 8 |

The Offering

| Securities offered by us: | ________ units, with each unit consisting of ______ shares of our common stock and ______ Purchase Warrants to purchase ______ shares of our common stock at an exercise price of $______ per share. The Units will not be certificated and the shares of common stock and the Purchase Warrants are immediately separable and will be issued separately in this offering. | |

| Common stock offered by us: | ______ shares. | |

| Purchase Warrants offered by us: | ______ Purchase Warrants, each providing the right to purchase ______ shares of our common stock. Each Purchase Warrant will have an exercise price per share of ______, will be exercisable on the original issuance date, and will expire on the fifth anniversary of the original issuance date. Each holder of Purchase Warrants will be prohibited from exercising its Purchase Warrant for shares of our common stock if, as a result of such exercise, the holder, together with its affiliates, would own more than 4.99% of the total number of shares of our common stock then issued and outstanding. However, any holder may increase such percentage to any other percentage not in excess of 9.99%, provided that any increase in such percentage shall not be effective until 61 days after such notice to us. This prospectus also relates to the offering of the shares of common stock issuable upon exercise of the Purchase Warrants. | |

| Common stock to be outstanding after this offering(1): | ______ shares. | |

| Option to purchase additional shares of our common stock and/or Purchase Warrants: | The underwriters have an option within 45 days of the date of this prospectus to purchase up to ______ additional shares of our common stock and/or Purchase Warrants at the public offering price, less the underwriting discount. | |

| The NASDAQ symbol for our common stock: | Our common stock is currently traded on the OTCQB. In connection with this offering, we expect to have our shares of our common stock listed for trading on the NASDAQ Capital Market under the symbol “CDXI”. | |

| Proposed NASDAQ listing for Purchase Warrants: | There is no established public trading market for the Purchase Warrants. We intend to seek a listing for the Purchase Warrants on NASDAQ under the symbol “CDXIW,” however we cannot assure you that we will be successful listing the Purchase Warrants on NASDAQ or, if successful, that an active trading market for the Purchase Warrants will develop or be sustained. | |

| Use of proceeds: | We estimate the net proceeds to us from the sale of ______ Units at an assumed combined public offering price of $______ per Unit will be approximately $______ million after deducting underwriting discounts and estimated offering expenses payable by us. If the underwriters exercise their option to purchase additional shares of our common stock and/or Purchase Warrants in full, we estimate that our net proceeds will be approximately $______ million after deducting underwriting discounts and estimated offering expenses payable by us. | |

| We intend to use the net proceeds from the sale of the Units to fund our research, development, and clinical programs, including the funding of our budgeted expenditures to develop our CDX-101 pharmaceutical candidate through IND and Phase I clinical testing and to complete our CHASE clinical trial targeting cardiovascular inflammatory health with our ZanthoSyn® astaxanthin dietary supplement, and for other general corporate purposes including repayment of certain indebtedness. See “Use of Proceeds” on page 25 of this prospectus. | ||

| Lock-ups: | We, our officers and directors, and certain holders of our capital stock will enter into lock-ups restricting the transfer of shares of or relating to our capital stock for six (6) months after the date of this prospectus. |

| 9 |

| Reverse Stock Split: | Prior to the effective date of this registration statement in which this prospectus is a part, our stockholders and our Board of Directors will have approved the Reverse Stock Split, and the Pricing Committee will have established the ratio for the Reverse Stock Split of 1-for-______. The Reverse Stock Split was effective at 12:01 a.m. on ______. Trading on our common stock on a post-Reverse Stock Split basis began at market open on ______. No fractional shares were issued in the Reverse Stock Split and any remaining share fractions were rounded up to the next whole share. | |

| In connection with the Reverse Stock Split, the Company’s authorized shares were reduced by the 1-for-______ ratio. Also, all shares of our common stock subject to outstanding equity awards and the exercise price of any such award (if applicable) and the number of shares remaining available for issuance under the Cardax, Inc. 2014 Equity Compensation Plan, as amended, and all shares underlying outstanding preferred stock and other derivative securities of the Company, including exercise prices and conversion rates (if applicable) were proportionately adjusted for the Reverse Stock Split. | ||

| Increase in Authorized Shares: | Prior to the effective date of this registration statement in which this prospectus is a part, our stockholders and our Board of Directors will have approved the Authorized Share Increase. The Company will file a Certificate of Amendment to the Company’s Certificate of Incorporation to effect an increase in the number of authorized shares of our common stock. As a result of the Authorized Share Increase and after giving effect to the Reverse Stock Split, the Company has ______ authorized shares of common stock. | |

| Risk factors: | You should read the “Risk Factors” section beginning on page 12 and other information included in this prospectus for a discussion of factors to consider carefully before deciding to invest in our securities. |

| (1) | The number of shares of our common stock outstanding immediately after this offering is based on ______ shares of our common stock outstanding as of ______ and gives effect to the Reverse Stock Split, and excludes: |

| ● | ______ shares of our common stock issuable upon the exercise of outstanding warrants; | |

| ● | ______ shares of our common stock issuable upon the exercise of outstanding options; | |

| ● | ______ shares of our common stock issuable upon the conversion of notes and other evidence of indebtedness; and | |

| ● | ______ shares of our common stock issuable upon exercise of the Purchase Warrants. |

| 10 |

SUMMARY FINANCIAL DATA

The following tables summarize our financial data for the periods presented and should be read together with the sections of this prospectus titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes thereto appearing elsewhere in this prospectus. The following summary statements of operations data for the years ended December 31, 2018 and 2017 and the six-months ended June 30, 2019 and 2018 have been derived from our financial statements and footnotes included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results we expect in the future.

| Operating Summary | Year ended December 31, 2018 | Year ended December 31, 2017 | Six-months ended June 30, 2019 (unaudited) | Six-months ended June 30, 2018 (unaudited) | ||||||||||||

| Revenues, net | $ | 1,510,875 | $ | 610,323 | $ | 210,363 | $ | 585,359 | ||||||||

| Cost of Goods Sold | (699,852 | ) | (274,707 | ) | (133,661 | ) | (281,201 | ) | ||||||||

| Gross Profit | 811,023 | 335,616 | 76,702 | 304,158 | ||||||||||||

| Operating Expenses | (4,833,518 | ) | (2,337,886 | ) | (2,240,377 | ) | (2,452,541 | ) | ||||||||

| Net Operating Loss | (4,022,495 | ) | (2,002,270 | ) | (2,163,675 | ) | (2,148,383 | ) | ||||||||

| Other Income (Expense) | (1,727 | ) | 17,036 | (53,439 | ) | 398 | ||||||||||

| Net Loss | $ | (4,024,222 | ) | $ | (1,985,234 | ) | $ | (2,217,114 | ) | $ | (2,147,985 | ) | ||||

The following summary balance sheet data as of June 30, 2019 is presented:

| ● | on an actual basis; and | |

| ● | on an as adjusted basis to give effect to our sale of ______ shares of our common stock in this offering at the assumed offering price of $______ per share, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

The summary as adjusted balance sheet is for informational purposes only and does not purport to indicate balance sheet information as of any future date.

| June 30, 2019 | ||||||||

| Actual | As Adjusted(1) | |||||||

| (Unaudited) | ||||||||

| Balance Sheet data: | ||||||||

| Cash | $ | 31,451 | $ | ______ | ||||

| Total assets | 2,088,698 | ______ | ||||||

| Total liabilities | 7,203,841 | ______ | ||||||

| Accumulated deficit | (64,160,432 | ) | (______ | ) | ||||

| Total stockholders’ equity (deficit) | $ | (5,115,143 | ) | $ | ______ | |||

| (1) | Each $1.00 increase (decrease) in the assumed public offering price of $______ per share would increase (decrease) the as adjusted amount of cash and cash equivalents, total assets, and total stockholders’ equity by approximately $______ million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. Each increase (decrease) of 100,000 shares in the number of shares offered by us would increase (decrease) the as adjusted amount of cash and cash equivalents, total assets, and total stockholders’ equity by approximately $______ million, assuming that the assumed public offering price remains the same, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. The as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. | |

| The as adjusted balances do not include the equity and debt raised by Cardax after June 30, 2019 and prior to the effective date of this prospectus in the amount $925,000. |

| 11 |

An investment in our common stock, any warrants to purchase our common stock, or any other security that may be issued by us involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included elsewhere in this prospectus, before making an investment decision. If any of the following risks actually occur, our business, financial condition, or results of operations could suffer. In that case, the trading price of our shares of our common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Forward-Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this prospectus.

Our management will have broad discretion as to the use of proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. You will not have the opportunity, as part of your investment decision, to assess whether these proceeds are being used appropriately. Our failure to apply these funds effectively could have a material adverse effect on our business and cause the price of our common stock to decline.

We are highly dependent on our senior management and certain consultants or other advisors, and if we are not able to retain them or to recruit and retain additional qualified personnel, our business will suffer.

We are highly dependent upon our senior management and certain consultants or other advisors, including David G. Watumull, our President and Chief Executive Officer, David M. Watumull, our Chief Operating Officer, Paresh N. Soni, our Chief Clinical and Regulatory Strategist, Gilbert M. Rishton, our Chief Science Officer, Jon L. Ruckle, our Chief Medical Officer, Timothy J. King, our Vice President, Research, and John B. Russell, our Chief Financial Officer. The loss of services of David G. Watumull or any other member of our senior management could have a material adverse effect on our business, prospects, financial condition, and results of operations. We carry $1 million “key person” life insurance policies on David G. Watumull and David M. Watumull, but we do not carry similar insurance for any of our other senior executives.

We may choose to increase our management personnel. For example, we will need to obtain certain additional functional capability, including regulatory, sales, quality assurance and control, either by hiring additional personnel or by outsourcing these functions to qualified third parties. We may not be able to engage these third parties on terms favorable to us. Also, we may not be able to attract and retain qualified personnel on acceptable terms given the competition for such personnel among companies that operate in our markets. The trend in the pharmaceutical industry of requiring sales and other personnel to enter into non-competition agreements prior to starting employment exacerbates this problem, since personnel who have made such a commitment to their current employers are more difficult to recruit. If we fail to identify, attract, retain, and motivate these highly skilled personnel, or if we lose current employees, our business, prospects, financial conditions, and results of operations could be adversely affected.

Our ability to grow and compete in the future will be adversely affected if adequate capital is not available to us or not available on terms favorable to us.

The ability of our business to grow and compete depends on the availability of adequate capital, which in turn depends in large part on our cash flow from operations and the availability of equity and debt financing. We cannot assure you that our cash flow from operations will be sufficient or that we will be able to obtain equity or debt financing on acceptable terms or at all to implement our growth strategy. As a result, we cannot assure you that adequate capital will be available to finance our current growth plans, take advantage of business opportunities, or respond to competitive pressures, any of which could harm our business. Additionally, if adequate additional financing is not available on acceptable terms, we may not be able to continue our business operations. Any additional capital, investment or financing of our business may result in dilution of our stockholders or be on terms and conditions that impair our ability to profitably conduct our business.

We are dependent upon the success of our products and technologies, which may not be successfully developed or commercialized.

While the FDA does not require clinical trials for dietary supplements, we have conducted and may continue to conduct clinical trials with our dietary supplements to promote scientific and consumer awareness. We also expect to conduct clinical trials with our pharmaceutical candidates. A failure of any clinical trial can occur at any stage of testing. The results of initial clinical testing may not necessarily indicate the results that will be obtained from later or more extensive testing. Additionally, any observations made with respect to blinded clinical data are inherently uncertain as we cannot know which set of data come from subjects treated with active versus placebo. Investors are cautioned not to rely on observations coming from blinded data and not to rely on initial clinical trial results as necessarily indicative of results that will be obtained in subsequent clinical trials or clinical practice.

Additionally, our products are subject to a variety of FDA and other applicable regulatory authorities. The extent of regulations applicable to our products, and the approvals or designations our products may receive from regulatory authorities, such as the FDA, are dependent upon the nature and development of our products and how such products are ultimately commercialized and marketed.

A number of different factors could prevent us from developing or commercializing our products on a timely basis, or at all.

We, the FDA, other applicable regulatory authorities, or an institutional review board (“IRB”), may suspend clinical trials of a product at any time for various reasons, including if we or they believe the subjects participating in such trials are being exposed to unacceptable health risks. Among other reasons, adverse side effects of a product on subjects in a clinical trial could result in the FDA or other regulatory authorities suspending or terminating the trial and refusing to approve or allow continued marketing of a particular product for any or all indications or applications of use.

| 12 |

Clinical trials require the enrollment of a sufficient number of subjects who meet certain eligibility criteria. Rates of subject enrollment are affected by many factors, and delays in subject enrollment can result in increased costs and longer development times.

Clinical trials also require the review and oversight of IRBs, which approve and continually review clinical investigations and protect the rights and welfare of human subjects. An inability or delay in obtaining IRB approval could prevent or delay the initiation and completion of clinical trials, and the FDA may decide not to consider any data or information derived from a clinical investigation not subject to initial and continuing IRB review and approval.

Numerous factors could affect the timing, cost, or outcome of our development and commercialization efforts, including the following:

| ● | delays in filing or acceptance of investigational new drug applications for our pharmaceutical candidates; | |

| ● | difficulty in securing centers to conduct clinical trials; | |

| ● | conditions imposed on us by the FDA or other regulatory authorities that are applicable to our business regarding the scope or design of our clinical trials or the method or scope of our sales and marketing practices; | |

| ● | problems in engaging IRBs to oversee trials or problems in obtaining or maintaining IRB approval of studies; | |

| ● | difficulty in enrolling subjects in conformity with required protocols or projected timelines; | |

| ● | third-party contractors failing to comply with regulatory requirements or to meet their contractual obligations to us in a timely manner; | |

| ● | our products having unexpected and different chemical and pharmacological properties in humans than in laboratory testing and interacting with human biological systems in unforeseen, ineffective or harmful ways; | |

| ● | the need to suspend or terminate clinical trials if the subjects are being exposed to unacceptable health risks; | |

| ● | insufficient or inadequate supply or quality of our products or other materials necessary to conduct our clinical trials; | |

| ● | our products not having the desired effects or having undesirable side effects or other unexpected characteristics; | |

| ● | the cost of our clinical trials being greater than we anticipate; | |

| ● | negative or inconclusive results from our clinical trials or the clinical trials of others for similar products or inability to generate statistically significant data confirming the efficacy or safety of the product being tested; | |

| ● | changes in the FDA’s other applicable regulatory authorities’ requirements for testing during the course of testing; | |

| ● | reallocation of our limited financial and other resources to other programs; and | |

| ● | adverse results obtained by other companies developing similar products. |

It is possible that none of the products we may develop will obtain the appropriate regulatory approvals necessary to begin selling them or that any regulatory approval to market a product may be subject to limitations on the indicated uses for which we may market the product. The time required to obtain FDA and other approvals is unpredictable, but often can take years following the commencement of clinical trials, depending upon the complexity of the product. Any analysis we perform of data from clinical activities is subject to confirmation and interpretation by regulatory authorities, which could delay, limit or prevent regulatory approval. Any delay or failure in obtaining required approvals could have a material adverse effect on our ability to generate revenue from the particular product.

We also must comply with clinical trial and post-approval safety and adverse event reporting requirements. Adverse events related to our products must be reported to the FDA in accordance with regulatory timelines based on their severity and expectedness. Failure to make timely safety reports and to establish and maintain related records could result in withdrawal of marketing authorization.

We may also become subject to numerous foreign regulatory requirements governing the conduct of clinical trials, manufacturing and marketing authorization, pricing, and third-party reimbursement. The foreign regulatory approval process includes all of the risks associated with the FDA approval described above as well as risks attributable to the satisfaction of local regulations in foreign jurisdictions. Approval by the FDA does not assure approval by regulatory authorities outside of the United States.

If we fail to comply with FDA regulations our business could suffer.

The manufacture and marketing of pharmaceuticals and dietary supplements are subject to extensive regulation by the FDA and foreign and state regulatory authorities. In the United States, pharmaceutical and dietary supplement companies such as ours must comply with laws and regulations promulgated by the FDA. These laws and regulations require various authorizations prior to a product being marketed in the United States. Manufacturing facilities and practices are also subject to FDA regulations. The FDA regulates the clinical testing, manufacture, labeling, sale, distribution, and promotion of pharmaceuticals and dietary supplements in the United States. Our failure to comply with regulatory requirements, including any future changes to such requirements, could have a material adverse effect on our business, prospects, financial condition, and results of operations.

Even after clearance or approval of a product, we are subject to continuing regulation by the FDA, including the requirements of registering our facilities and listing our products with the FDA. We are subject to reporting regulations. These regulations require us to report to the FDA if any of our products may have caused or contributed to a death or serious injury and such product or a similar product that we market would likely cause or contribute to a death or serious injury. Unless an exemption applies, we must report corrections and removals to the FDA where the correction or removal was initiated to reduce a risk to health posed by the product or to remedy a violation of the Food, Drug, and Cosmetic Act. The FDA also requires that we maintain records of corrections or removals, regardless of whether such corrections and removals are required to be reported to the FDA. In addition, the FDA closely regulates promotion and advertising, and our promotional and advertising activities could come under scrutiny by the FDA.

| 13 |

The FDA also requires that manufacturing be in compliance with its Quality System Regulation, or QSR. The QSR covers the methods and documentation of the design, testing, control, manufacturing, labeling, quality assurance, packaging, storage, and shipping of our products. Our failure to maintain compliance with the QSR requirements could result in the shutdown of, or restrictions on, our manufacturing operations, to the extent we have any, and the recall or seizure of our products, which would have a material adverse effect on our business. In the event that one of our suppliers fails to maintain compliance with our quality requirements, we may have to qualify a new supplier and could experience manufacturing delays as a result.

The FDA has broad enforcement powers. If we violate applicable regulatory requirements, the FDA may bring enforcement actions against us, which could have a material adverse effect on our business, prospects, financial condition, and results of operations. Violations of regulatory requirements, at any stage, including after approval, may result in various adverse consequences, including the delay by a regulatory agency in approving or refusal to approve a product, withdrawal or recall of an approved product from the market, other voluntary agency-initiated action that could delay further development or marketing, as well as the imposition of criminal penalties against the manufacturer and NDA holder.